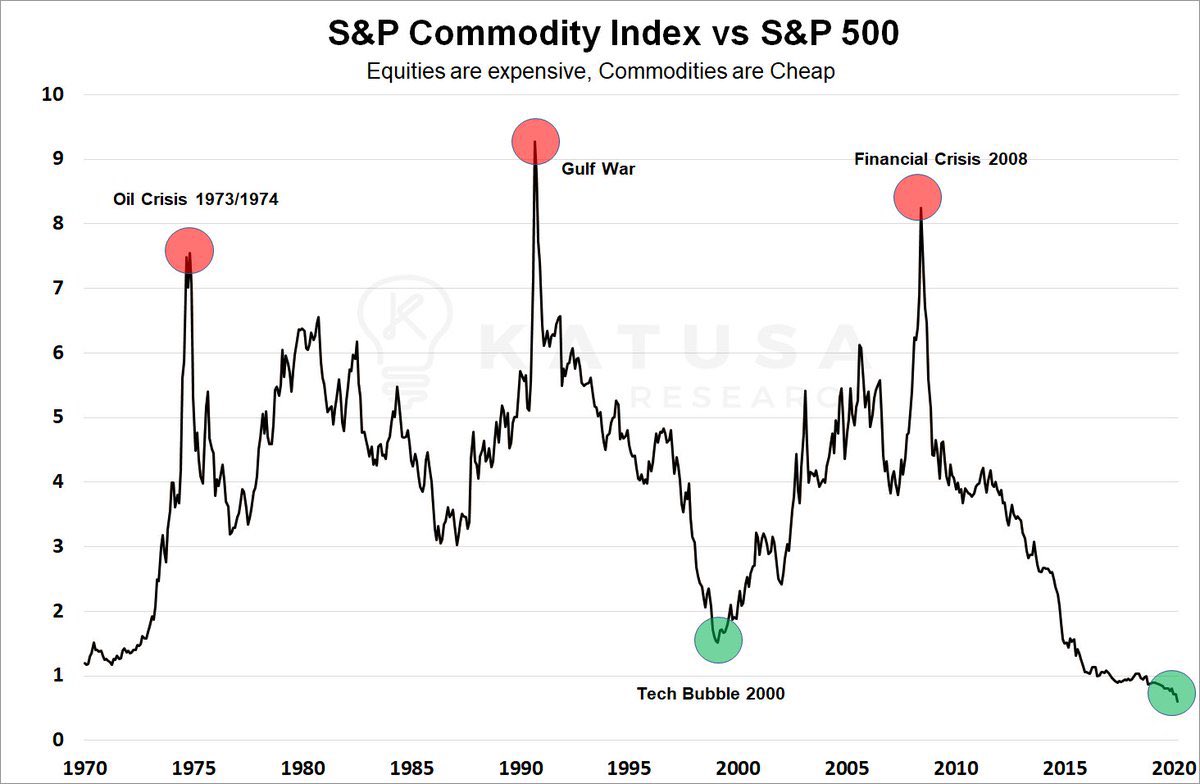

Michael A. Arouet on Twitter: "Commodities to S&P 500 ratio in historical context 👇 Even at current „modest“ level inflation is out of control. Chart @AnnaSvahn_ https://t.co/VftwKSUyfM" / Twitter

Javier Blas on Twitter: "CHART OF THE DAY: The Bloomberg Commodity Spot index, a basket of 23 raw materials from oil to wheat and aluminium, has surged to a fresh all-time high,

Grant Hawkridge on Twitter: "After 18 months of a sideways mess... the last 4 months, we have seen the trend change, and now commodities are outperforming stocks... Is this just the beginning

Dept. of Agriculture on Twitter: "Supply Chain Disruptions, Rising Commodity Prices, General CPI #AgOutlook https://t.co/YMydgZK4js" / Twitter

David Ingles on Twitter: "Commodity prices saw the biggest one-day gain in 13 years on Tuesday https://t.co/h0k08oCVcH https://t.co/WyMRIZ71dO" / Twitter

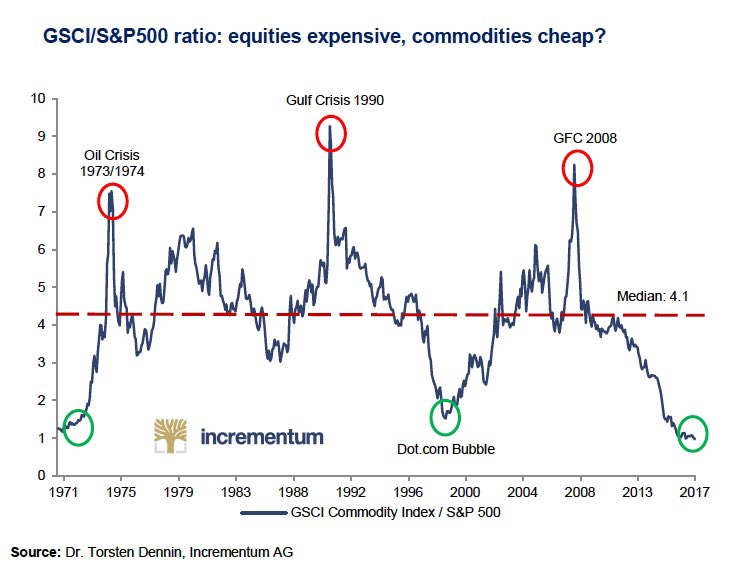

jeroen blokland on Twitter: "#Commodities vs #equities! Chart via @crescatkevin https://t.co/eOzcYv6WlD" / Twitter

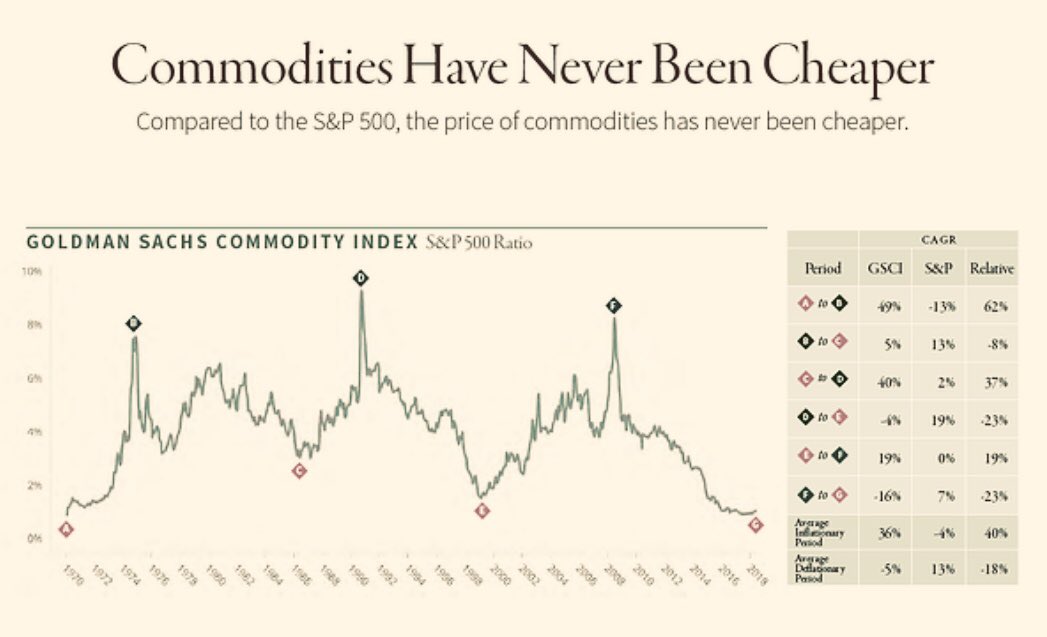

Jesse Felder on Twitter: "Over the past 45 years commodities have not been cheaper relative to equities than they are today https://t.co/InQuCAECDC https://t.co/F5pLZXTyKj" / Twitter

jeroen blokland on Twitter: "10-year rolling #commodity returns are the lowest since 1924! https://t.co/oDpfJknPU0" / Twitter

Otavio (Tavi) Costa on Twitter: "Commodities-to-S&P 500 ratio just reached a fresh 50-year low! Amazes me how many ways stocks look absurdly overvalued at the likely top of the business cycle. https://t.co/HSuMBEYMZ8" /

Stephen Stapczynski on Twitter: "Commodity prices surged to a new record⚠️ 📈 The Bloomberg Commodity Spot Index (which tracks prices for raw materials) rose to an all-time high 📈 The move was

AnthonyCFA on Twitter: "#Futures $CRB #OATT #Commodities vs $SPY 👀 “Measuring commodity prices vs. S&P 500 shows that we are approaching a 100-year low valuation. The only other periods that have approached

Jurrien Timmer on Twitter: "With commodities reversing their gains, here's every major commodity rally since 1784. Stocks make V-bottoms but commodities make V-tops (or is that carrot tops?). The rally in crude

Jurrien Timmer on Twitter: "How long can this commodities boom last? Here we see the current move in crude oil, nickel, and wheat, against a composite of 250 years' worth of commodity

David Andolfatto on Twitter: "Would be good to know if falling commodity prices due to increased commodity supply or lower commodity demand. Either way, pattern suggests inflation likely to moderate. https://t.co/edFtqVXxFo" /

Linda P. Jones on Twitter: "🧵I just reviewed the Digital Commodity Exchange Act #DCEA and two things jumped out at me. 1) It says it permits "trading in only digital commodities that

Jim Bianco biancoresearch.eth on Twitter: "The CRB Raw Industrial Spot Index just made a new all-time high yesterday. (This is considered the commodity index that best reflects input prices) And the Bloomberg

Kevin Bambrough on Twitter: "Most important chart right now. Forget the noise and volatility. Those who make the switch to commodities and commodity related stocks will massively out perform over the next

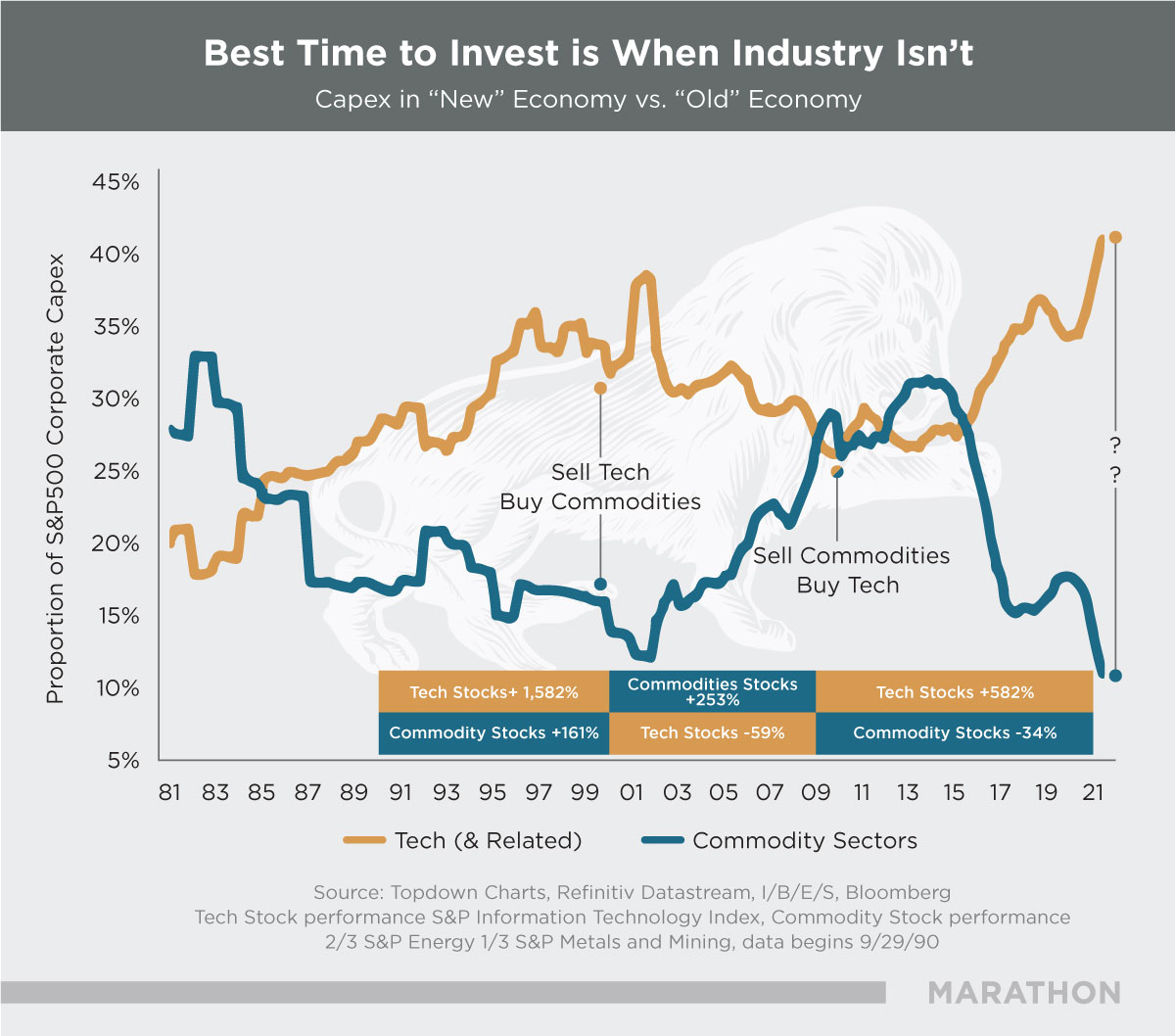

Ángel Martín Oro on Twitter: "Commodity sectors Capex vs Tech Capex as proportion of total S&P 500 Capex. Nice chart. Read more here: https://t.co/8UAiWqGERW By @topdowncharts @Callum_Thomas #CapitalCycles cc @jorge_moj https://t.co/u7j0clO7uO" /

True Insights on Twitter: "The Bloomberg Commodity Index is heading for new highs driven by #energy prices. What is your position, and did you change that in recent weeks as the odds

ʎllǝuuop ʇuǝɹq on Twitter: "BofA Survey shows collapsing growth expectations... And max long commodities.... an extremely aggressive stagflation bet. I doubt both views will be vindicated from here. The best cure for